The past weeks brought a flurry of signals that Washington and NATO are edging toward a harder, clearer Ukraine policy. The Wall Street Journal reports that President Trump has authorized U.S. intelligence support for Ukrainian long-range strikes on Russia’s energy infrastructure. Senior officials are “looking at” supplying Tomahawk cruise missiles. Kyiv pushes for deeper reach. Moscow threatens “appropriate” retaliation, while insisting Tomahawks wouldn’t change the battlefield.

They’re wrong. Tomahawks would change the campaign’s geometry, tempo, and economics. Here’s how and why that matters for Europe’s security and the rules-based order.

1) The policy shift: from restraint to enabling deep precision strikes

Two decisions stand out:

- U.S. intelligence for long-range targeting inside Russia. For the first time under the current administration, U.S. agencies would support Ukrainian strikes on refineries, pipelines, power stations and logistics nodes far beyond the frontline. That moves Washington from gatekeeper to enabler of deep operations designed to degrade the Kremlin’s war economy.

- Active consideration of Tomahawk supply. Vice President JD Vance confirmed the option is on the table. President Zelensky pressed the case at the UN. In parallel, the U.S. is delivering Patriot and HIMARS through a NATO-financed arrangement, and allies are urged to match the shift.

This matters because precision at range is not just about hitting things far away, but it’s about imposing strategic dilemmas on Russia: defend the front or defend the heartland; fuel the economy or fuel the war.

2) Why Tomahawks are different

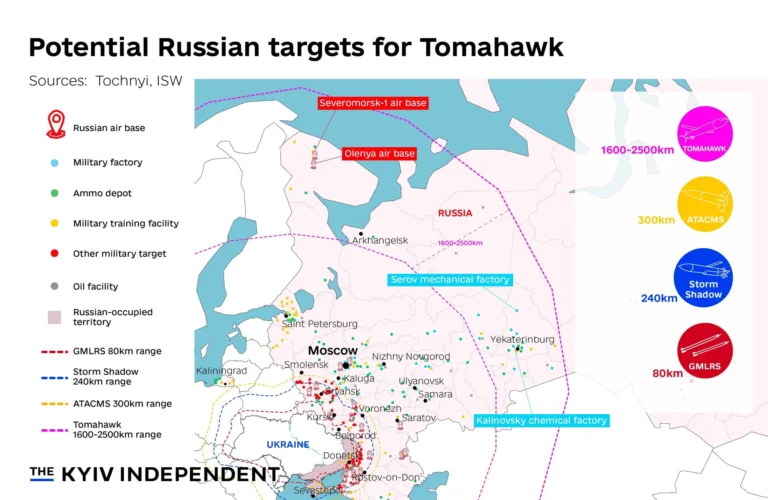

Ukraine already fields impressive Western tools: Storm Shadow/SCALP (≈250 km), ATACMS (various ranges), and an innovative drone arsenal. Tomahawks add a distinct tier:

- Range: commonly 1,000–1,700 km (export configuration can be range-limited), opening all of European Russia to targeted disruption, including Moscow, St. Petersburg, Murmansk, and deep logistics corridors.

- Accuracy & survivability: low-altitude terrain-following, multi-mode guidance, mid-course retargeting, and loitering make them hard to intercept and surgically precise (tens of meters CEP).

- Payload: ~400–450 kg warhead: an order-of-magnitude leap over most Ukrainian long-range drones. Where 50 kg dents a refinery, 450 kg forces a shutdown.

- Scalable employment: salvo fires from dispersed mobile launchers (see Typhon below) enable campaign-level effects, not one-off pinpricks.

Put simply: Tomahawks turn “psychological disruption” into industrial-scale denial.

3) Targets that change the war’s economics

Tomahawks would supercharge three ongoing Ukrainian lines of effort:

a) Energy infrastructure: refineries, gas-oil pipelines and tank farms

Ukraine’s drone campaign already pushed Russian diesel exports to multi-year lows, producing fuel shortages and price spikes. Tomahawks would:

- Deliver deep, precise, repeatable hits against catalytic reformers, distillation columns, and power substations that refineries depend on.

- Extend the outage duration from weeks to months, imposing costly rebuilds and insurance shocks.

- Force Russia to divert advanced air defenses to guard industrial sites, thinning coverage at the front.

Every refinery offline shrinks Russia’s fiscal cushion and its capacity to sustain missile production, logistics and domestic stability.

b) Air bases and strategic aviation hubs

Olenya (Murmansk Oblast) and other bases launching mass strikes have sat outside consistent reach. Tomahawks enable:

- Runway-kill and infrastructure denial (fuel farms, maintenance hangars, munitions depots).

- Sustained attrition of bomber sortie generation capability without risking scarce Ukrainian aircraft.

This blunts Russia’s massed strike cycles against Ukrainian cities and grid infrastructure—buying Ukraine breathing space through winter.

c) C2, logistics, and production bottlenecks

Tomahawks can target:

- Command nodes orchestrating regional air defense and strike coordination, complicating Russia’s operational picture.

- Rail marshaling yards & bridges feeding the front, forcing longer, less efficient routes.

- High-value components in missile and drone production chains—harder to replace than warehouses.

The cumulative effect is a systemic increase in Russia’s cost per unit of combat power.

4) Integration challenges and realistic solutions

Critics note Tomahawks are typically launched from ships and submarines; Ukraine has neither. Two workarounds exist:

- Typhon (Aegis Ashore-derived) mobile launcher. Designed to fire Tomahawk and SM-6 from land. Deployable, concealable, and compatible. If provided with training, Typhon gives Ukraine a survivable ground-based long-range strike complex.

- Partner-enabled launch. In extremis, allied platforms outside Ukrainian control could launch upon Ukrainian tasking. Politically complex, but technically straightforward.

Yes, training and integration take time. But Ukraine has repeatedly absorbed complex Western systems (Patriot, HIMARS, ATACMS) on compressed timelines, because incentives are existential.

5) The alternatives (and complements)

- JASSM (≈1,000 km, air-launched) offers range and punch, especially if integrated on Ukrainian jets.

- German long-range systems reportedly coming “very soon” could add another vector.

- Indigenous missiles (e.g., Flamingo) promise range and payload, but serial production is not yet massed.

This is not either/or. A mixed portfolio complicates Russian defenses and mitigates supply risk.

6) Moscow’s bluster and why it rings hollow

The Kremlin threatens “appropriate” responses while claiming Tomahawks won’t change the battlefield. Both lines are familiar:

- Escalation scare tactics aim to deter Western resolve. Yet Russia has consistently calibrated below NATO thresholds when faced with credible deterrence.

- Minimization of Western systems precedes visible impact (HIMARS, ATACMS, Patriot). Then the air defense redeployments begin, and the strike patterns change.

The very fact that Russia warns and downplays simultaneously is a tell: they expect pain.

7) Europe’s ammunition reality and the Czech hinge

Ukraine’s decisive advantage is adaptation; its constraint is sustainment. The Czech-led ammo program has quietly procured millions of shells from non-NATO sources, bridging Western production gaps. Domestic politics in Prague now put that pipeline at risk.

Two implications:

- Long-range missiles cannot replace artillery, Ukraine needs both. Frontline fires hold ground while deep strikes dislocate Russia’s rear.

- If the Czech model falters, allies must institutionalize off-bloc procurement or rapidly scale EU/NATO production, with ring-fenced allotments for Ukraine.

Strategic effect = fires at the front + outages in the rear.

8) Why Russia must lose and what “lose” means

This isn’t abstract morality; it’s strategic necessity.

- Deterrence and the UN Charter. Territorial conquest rewarded becomes a template. If Russia consolidates gains by force, every revanchist state takes note, from Europe’s periphery to the Indo-Pacific.

- Security of NATO territory. Repeated Russian drone/airspace incursions into Poland and others demonstrate intent to probe. A stalemated or victorious Russia remains a permanent engine of instability.

- Economics and energy blackmail. A Russia cushioned by intact refining/export capacity finances rearmament and political warfare. Degrading that capacity constrains coercion.

- Justice and prevention. Deportations of Ukrainian children, filtration, torture, and mass strikes on civilian infrastructure are not “incidents”; they are methods. A Russian defeat denies impunity and deters repetition.

“Lose” means failing to achieve war aims: no legal recognition of occupied territories, no frozen conflict on Kremlin terms, no veto over Ukraine’s sovereign choices. It means a Russia deterred, not emboldened.

9) What Tomahawks unlock strategically

- Campaignable depth. From episodic raids to sustained denial of Russia’s critical nodes.

- Air defense dilution. S-300/400 units pulled from the front to guard strategic assets increase Ukrainian freedom of action at the line.

- Winter resilience. Reduced Russian strike capacity against Ukraine’s grid lowers humanitarian and economic pressure.

- Negotiation leverage. Talks move when costs mount. Deep precision strike is leverage.

- Alliance credibility. Delivering what’s necessary, despite threats, signals that coercion doesn’t work on NATO.

10) The prudent course of action

- Provide Tomahawks with Typhon launchers, training, and a clear ruleset aligned with international law (strikes on military and dual-use war-sustaining targets).

- Maintain parallel growth in artillery and air defense, this is a systems fight.

- Protect the Czech ammo model or replace it with a NATO/EU-coordinated, secrecy-preserving mechanism.

- Harden Western political will with simple messaging: deep strikes reduce Russia’s capacity to bomb cities and shorten the war.

Bottom line

Tomahawks won’t win the war alone, but they reshape it, amplifying Ukraine’s proven ingenuity with range, precision, and payload that bite where Russia is most vulnerable: its energy lifelines, strike bases, and command networks. Pair that with sustained ammunition and air defense, and the Kremlin’s cost curve bends up while its options bend down.

Ukraine needs tools that change Moscow’s calculus. Tomahawks do exactly that. And if Europe wants a future where borders are not revised by missiles and lies, Russia must lose this war.